Air Conditioning Units Financing Made Simple

- shawncovenantaire

- Sep 14

- 9 min read

Updated: Sep 15

When your AC gives up the ghost in the middle of a heatwave, the last thing you want to worry about is how to pay for a new one. Coming up with thousands of dollars in cash on the spot just isn't realistic for most people.

That’s where air conditioning units financing comes in. It’s a lifesaver, allowing you to get a brand-new, efficient system installed right away and spread the cost out into manageable monthly payments. This way, you get the comfort you need without having to empty your savings account.

Your Guide to AC Financing Options

Let's be honest, facing an AC replacement is stressful, and the price tag is a big part of that. The good news? Financing makes this major purchase much less intimidating. Think of it like a roadmap to comfort: there are several different routes you can take depending on your financial situation. From personal loans to special plans offered directly by HVAC contractors, each path has its own perks.

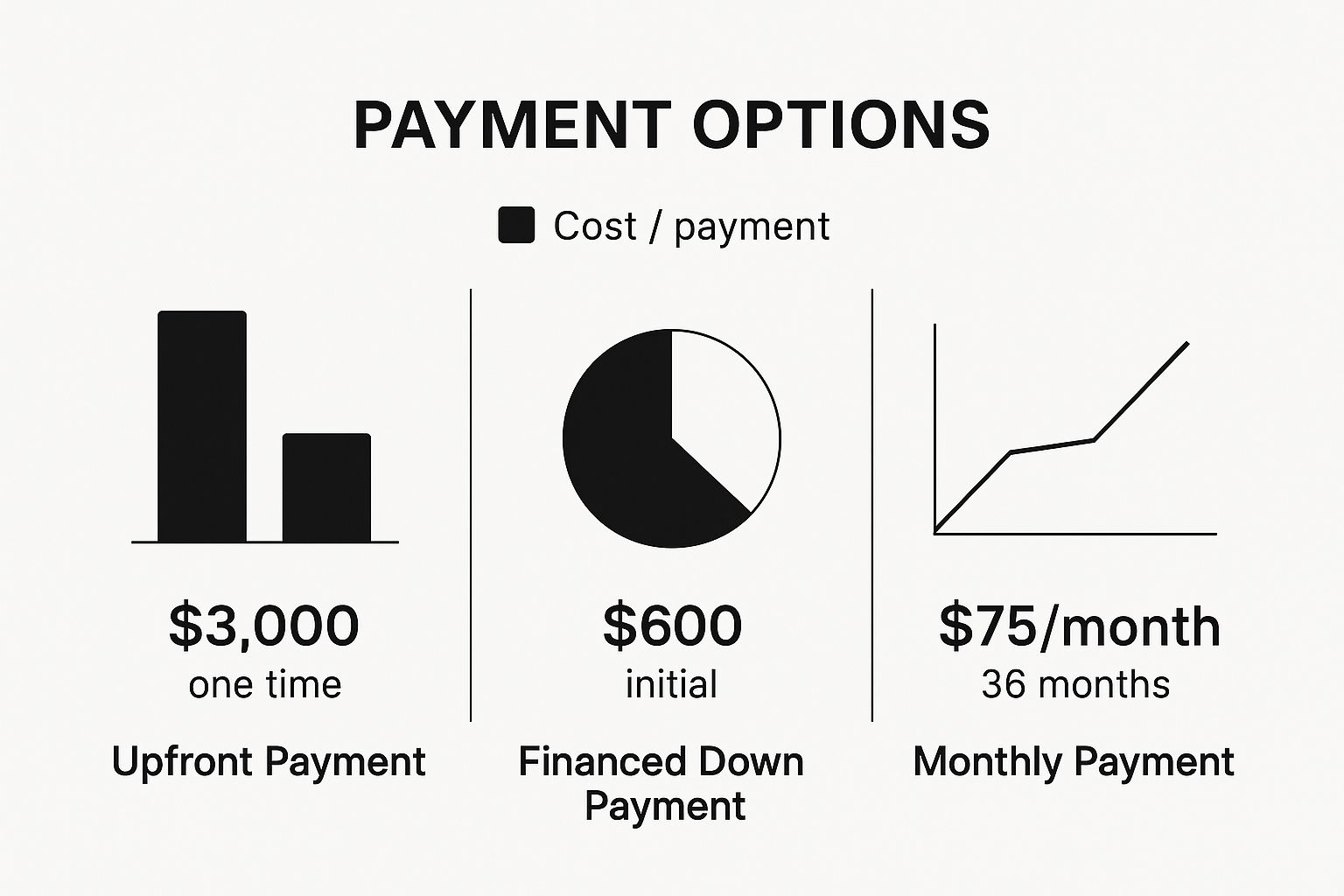

This visual really drives home how financing can turn a huge one-time expense into something much more predictable.

As you can see, what starts as a daunting upfront cost can be broken down into a small initial payment and low monthly installments. It's a game-changer.

To give you a clearer picture, let's quickly compare some of the most common financing methods.

Quick Comparison of AC Financing Options

Financing Type | Typical Interest Rate | Best For | Key Consideration |

|---|---|---|---|

HVAC Company Financing | 0% - 15% | Homeowners seeking convenience and promotional deals like 0% APR. | Often tied to specific brands or models; requires good credit. |

Personal Loans | 6% - 36% | Those with good credit who want flexibility in how they use the funds. | Interest rates can be high for those with lower credit scores. |

Home Equity Loans/HELOCs | 7% - 10% | Homeowners with significant equity looking for lower interest rates. | Uses your home as collateral, which adds a layer of risk. |

Credit Cards | 15% - 25%+ | Emergency situations or for those who can pay off the balance quickly. | High-interest rates can make it a very expensive option long-term. |

Each of these paths has its place, and the best one for you really depends on your personal financial landscape.

Understanding the Growing Demand for Financing

It's not just you; more and more homeowners are choosing to finance their new HVAC systems. In fact, residential spending on home improvements is on track to hit an incredible USD 477 billion by 2025, and a huge chunk of that is going toward heating and cooling upgrades.

Government programs have also helped push this trend along by creating new incentives. You can get a full rundown of the different HVAC financing options and ways to save on your system in our detailed guide.

For instance, the U.S. Inflation Reduction Act rolled out tax credits of up to $2,000 for installing energy-efficient heat pumps. Suddenly, those top-of-the-line systems feel a lot more attainable.

On top of that, initiatives like the Green Homes Grant Voucher scheme can help homeowners offset the initial cost of energy-efficient upgrades. These programs make investing in a high-efficiency unit an even smarter financial move.

Choosing the Right AC Financing Plan

Not all loans are created equal, and picking the right air conditioning units financing plan means you have to understand their financial DNA. The options typically fall into two main buckets: secured and unsecured loans, and they each come with their own set of rules.

Think of it this way: a secured loan is like leaving your car title with a friend as collateral when you borrow money. It’s a lower risk for the lender because they have a claim on an asset, like your home, if you can’t pay.

An unsecured loan, on the other hand, is based purely on your promise to pay it back. Your credit score and financial history are the only guarantees the lender has, making it a bit more like a firm handshake agreement.

Unsecured vs. Secured Financing

When you start looking at financing, you'll run into these two types constantly. Each one serves a different purpose and fits a different financial situation.

Unsecured Loans (Personal Loans, Dealer Financing): These are the most common for AC purchases. Approval is based on your creditworthiness, not collateral. They’re often faster to process but may come with slightly higher interest rates.

Secured Loans (Home Equity Loans, HELOCs): These loans use your house as security. Because the lender’s risk is lower, they typically offer better interest rates and longer repayment terms, which is great for bigger home projects.

A key factor in your decision will be the size and efficiency of the system you need. You can get a better feel for what system fits your space by checking out our guide on how to size an air conditioner for your home.

The Appeal of Dealer Financing

Many homeowners find that financing directly through their HVAC contractor is a really attractive option. These plans are super convenient and often come with special promotional offers that are hard to pass up.

A common promotion is 0% APR (Annual Percentage Rate) for a limited time, like 12 or 18 months. This means you can pay off the unit without any interest charges if you clear the balance within that promotional window.

This kind of offer is a powerful tool, since it’s basically an interest-free loan. Just be sure you understand the fine print, as some agreements will charge retroactive interest if the balance isn't paid in full on time. Our goal here is to demystify this financial jargon so you can confidently pick the best plan for you.

How to Qualify for an AC Unit Loan

When you're ready to finance a new air conditioner, lenders are going to take a close look at your financial snapshot to figure out their risk. The biggest piece of that puzzle is your credit score. Think of it as your financial report card; it’s a simple, three-digit number that tells them how you've handled debt in the past.

A higher score is a green light for lenders. It tells them you're a lower-risk borrower, which almost always means you’ll get better loan offers. In practice, a strong credit history can open the door to lower interest rates and more flexible repayment plans, saving you a lot of money over the life of the loan.

Key Factors Lenders Consider

While your credit score gets most of the attention, lenders look at a few other key things to get the full picture. They want to see a stable and complete financial situation before making an offer.

Credit Score: Lenders love to see a score of 700 or higher. This range is generally considered "good" and puts you in the best position for top-tier rates. If your score is between 600 and 699, you're often seen as having "fair" credit, while a score below 600 might mean facing higher interest rates or a tougher approval process.

Debt-to-Income (DTI) Ratio: This is a simple calculation of how much of your monthly income is already going toward debt payments. Lenders get nervous when this number gets too high. Ideally, they want to see a DTI ratio below 43%, which shows you have plenty of room in your budget for another payment.

Proof of Income: It’s all about stability. Lenders need to see that you have a steady income stream to cover the loan. You'll likely need to provide recent pay stubs, bank statements, or tax returns to confirm your earnings.

Giving your finances a quick check-up before you apply is always a smart move. You can pull your credit reports for free from the major bureaus to scan for any errors. If your credit is a concern, it's worth exploring some general strategies for getting a loan with a low credit score to see what options might be out there.

Taking action now can make a real difference. For instance, paying down some existing debt can lower your DTI ratio. Even small improvements can make your application much stronger and help you lock in better financing terms.

Once you understand what lenders are looking for, you can put your best foot forward. If you'd like to explore flexible https://www.covenantairesolutions.com/financing, our team is here to help you find a plan that works for you and your budget.

Cracking the Code: The AC Financing Application Process

Alright, so you’ve gotten a few quotes for a new system and have a ballpark number in mind. Now what? Applying for air conditioning units financing might seem like a mountain of paperwork, but it's really just a few straightforward steps.

First up is pre-qualification. This is your chance to test the waters with different lenders. You'll give them some basic financial info, and they'll give you an idea of what kind of loan you might get. The best part? This is usually a "soft" credit check, which does not impact your credit score. It’s like window shopping for the best deal without any commitment or penalty.

Getting Your Ducks in a Row

Once you've picked a lender you like, it's time to make it official. To speed things along, it helps to have all your documents ready to go. Think of it as building a quick financial profile for them.

You’ll generally need to pull together:

Proof of Income: Grab your most recent pay stubs, W-2s, or the last couple of years of tax returns.

Identification: A standard government-issued ID, like your driver's license, will do the trick.

Proof of Residence: A recent utility bill or bank statement with your current address on it works perfectly.

With these items handy, you can breeze through the formal application. And while you're at it, our guide on expert air conditioning installation tips can help you get fully prepared for the project itself.

It's easy to get tunnel vision on the monthly payment, but don't forget to look at the big picture. The true cost of any loan is wrapped up in its interest and fees. Always compare the Annual Percentage Rate (APR) and the total loan cost to see what you'll really pay over time.

This way, you can confidently compare your options and pick the one that's truly the most affordable in the long run.

Weighing The Costs And Benefits Of Financing

Deciding to finance a new air conditioner is a big step, and it’s smart to look at it from all angles. The biggest plus? You get immediate relief from the heat without having to drain your savings account all at once. This means you can get a high-efficiency system installed right away, a move that often starts paying for itself much faster than you'd think.

A modern, energy-efficient unit can seriously cut down your monthly power bills, often by as much as 20%. In many cases, these monthly savings are enough to help offset the financing payments, making the whole deal feel much more manageable.

And don’t forget, a new AC system is a major home improvement. It’s a huge selling point for potential buyers and can genuinely increase your home's resale value. What starts as a necessary expense can quickly become a smart long-term investment in your property.

Understanding The True Cost Of A Loan

The main downside of any loan is the interest, which is wrapped up in the Annual Percentage Rate (APR). While a low monthly payment can look tempting, that interest adds up over the life of the loan. It's really important to look past that monthly number and understand the total amount you'll be paying back.

To get the full picture, you need to factor in everything. It’s not just the purchase price and financing; you also have to account for ongoing expenses like AC services and maintenance. This is the only way to know the real long-term cost.

Let’s break it down with an example. Say you finance a $6,000 AC unit for five years with a 10% APR. By the time you’re done, you'll have paid back around $7,950. That means you paid about $1,950 in interest alone.

The Bigger Picture Of AC Investment

The push for energy efficiency has completely shaken up the air conditioning world, and big money is flowing into the industry. The average funding round for new AC tech is now around USD 37.6 million, with over USD 1 billion invested in developing more sustainable cooling solutions. This just goes to show how much the industry is shifting toward high-performance, money-saving systems.

When you're upgrading, you might even be weighing a new AC against a super-efficient heat pump. Each has its own financial perks, and our guide on heat pump vs AC cost can help you sort through the numbers.

Ultimately, financing is what makes these advanced, cost-saving units accessible to more homeowners today, letting you enjoy the comfort and savings now instead of later.

Of course, here is the rewritten section with a more human and natural tone, following all your specific instructions.

Common Questions About Financing an AC Unit

Even when you feel like you have a solid plan, a few lingering questions about air conditioning units financing are perfectly normal. Getting those last few concerns cleared up can give you the final bit of confidence you need to move forward with such an important investment in your home.

One of the first questions people ask is about credit scores. "Can I get financing if my credit isn't perfect?" The short answer is almost always yes. While a top-tier credit score will definitely land you the best interest rates, plenty of lenders are willing to work with people who have fair or even poor credit. You might be looking at a higher interest rate, but it's rare to be left without any options at all.

Understanding Key Financing Details

Another thing that often trips people up is promotional financing, especially those tempting 0% interest offers. These can be incredible deals, but you absolutely have to read the fine print.

A lot of these offers hinge on you paying off the entire balance before the promotional period is over. If you don't, you could get hit with retroactive interest on the full original loan amount. That's a nasty surprise nobody wants.

Finally, homeowners frequently ask if a new AC unit genuinely adds value to their house. The answer is a resounding yes. A modern, energy-efficient system isn't just a comfort upgrade; it's a major selling point for potential buyers. It can boost your home's resale value, making it a truly worthwhile investment in the long run.

Ready to explore financing options that actually make sense for your budget? Covenant Aire Solutions offers flexible plans designed for homeowners like you. Find out how affordable your new AC can be.